Follow Lilach

Tax Tips for the Self-Employed

If you’re self-employed and work from home, these tax deductions could help you recoup your costs.

While working from home is a great perk that offers many benefits, it also has its downsides. Your business expenses and utility bills can rise considerably as you conduct business from home. Everything from your electric bill to the subscription-based software you need, it adds up quick. Fortunately for you, there are several available deductions to help recuperate your costs.

Keep in Mind

Most of these deductions apply to those who are self-employed and work from home. However, a few of them could apply to those who are not self-employed but do work from home.

Tax Tips for the Self-Employed

The Home Office Deduction

This deduction is one that’s worth determining if you qualify for. It can dramatically increase your tax savings and is well worth the extra effort needed to determine if you qualify. It can help you recuperate the costs of operating your home office and business-related expenses. However, if you’re an employee of a company (i.e. you receive a W-2), you are no longer eligible for this deduction.

How to Qualify

In order to qualify for this deduction, your home office must meet a few conditions. The first condition is that the space in your home must be used exclusively and regularly for your business. The second condition is that it must be the principal place of your business.

Exclusive and Regular Use

The IRS explains that there must be a dedicated part of your home that is used for no purpose other than conducting business. For example, if you have a room dedicated as your home office, that is strictly used to regularly conduct business, you can take the home office deduction for that room.

Principle Place of Business

In addition to the exclusive and regular use test, this condition must also be met. The IRS states, “you must show that you use your home as your principal place of business.” However, you may still qualify if you conduct business at a location outside of your home but also use your home substantially and regularly.

Sidenotes:

- This deduction is not exclusively for rooms or spaces inside your home. You may also claim this deduction on a separate part of your home such as a garage, shed, detached studio, etc.

- There are special exceptions for those who conduct a daycare business and for those who use part of their home for storage purposes for their business.

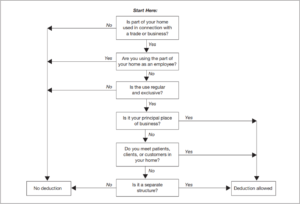

The IRS has also put together a helpful visual guide to help you determine if you could be eligible for this deduction.  Note: This chart does not apply to storage use of the home or daycare filers.

Note: This chart does not apply to storage use of the home or daycare filers.

How to Calculate It

There are two ways to calculate this deduction. The first is calculated based on the percentage of your office space and home. For example, if your office is 150 square feet and your home is 1,500 square feet then your business percentage is 10%.

That 10% can be applied to the following expenses, including, but not limited to:

- Direct Expenses

- The IRS describes this as expenses that only apply to the business part of your home. For example, if you paint your office space or replace a light fixture.

- Indirect Expenses

- This expense is described as an expense that is used for maintaining and running your entire home. Common examples include insurance, utilities, and general repairs.

- Rent

- If you rent your home, you can deduct the same percentage of your rent as the percentage of your home devoted to your business.

- Depreciation

- If you own the home, you can claim a deduction on the business part of your home. However, if you eventually sell the home at a profit, you will be subject to a capital gains tax which may negate any tax savings.

Note: If your gross income from your business is greater than or equal to your total business expenses, then you can deduct all your business expenses related to the use of your home. If your gross income is less than the expenses, your deduction will be limited.

The second method is a simplified version that uses a set rate per square foot multiplied by the square footage of your office. The rate is set at $5 per square foot with a maximum of 300 square feet. For example, if you have an office that measures 200 square feet, then your deduction would be $1,000 ($5/sq. ft X 200).

This method is great for those whose business expenses are less than their gross income or just don’t want to go through the hassle of calculating it.

For a more in-depth look at the Home Office deduction, the IRS has provided a very detailed (and very long) publication here.

For those who use their home as a daycare or for storage of inventory or product samples, you should refer to the IRS Publication linked above. These two circumstances are very different in how they’re calculated and applied.

Work-Related Expense Deduction

When you’re self-employed, you are the one who must provide all your own equipment and funding in order to conduct your business. As such, you can deduct almost anything you can think of that’s necessary for you to conduct business.

- Office Supplies & Business Equipment

- You can deduct basically anything that is deemed necessary for you to run your business. Anything from printer paper to the software subscription needed to run your business, and anything in between.

- Travel Expenses

- If you’ve ever needed to travel to visit clients, attend a trade-show, etc. then you are eligible to deduct mileage, airfare, lodging, and other travel-related expenses.

- Business Related Meals/Entertainment

- You may deduct 50% of the cost of business meals so long as you are present along with a potential customer, client, or something of a similar fashion. The IRS states that the meals must, “not be considered lavish or extravagant.” Check here for more details.

- Training and Education

- Anyeducationortraining that maintains or improves your job skills or that you are required to do by law to keep any credentials/certifications can be deductible. You can deduct tuition, books, fees, etc. Check here to see if you qualify.

- Health Insurance Premiums

- If you’re self-employed, health insurance can be 100% deductible for you and your spouse/dependents if: Your business is claiming a profit for the year and you and your spouse/dependent were not eligible for healthcare for the months you will be claiming them.

Mistakes to Avoid:

- Not staying organized and saving ALL receipts.

- If you do not keep an organized file of ALL your business expenses with receipts, you are setting yourself up for a lower tax return. Not only that, but not keeping track of your expenses could damage your business. Using the data of expenses can also help you budget for future business endeavors.

- Claiming deductions that are not actually deductible.

- With so many deductions and the complicated nature of tax laws, it’s likely to happen from time to time. Do not be afraid to seek professional advice/help if needed.

- Combining business and personal expenses.

- You should never combine business and personal expenses. This is a fast track to getting yourself audited. You should absolutely under no circumstances try to commit tax fraud. It’s not worth the extra few bucks you might get.

- Thinking a credit card statement will suffice in lieu of receipts.

- Credit card statements will not suffice, as they are not itemized and only show the total amount purchased. For example, if you bought a printer from Amazon that shows a $500 purchase on your statement, how is the IRS to know if that printer is all that was included in that purchase?

Disclaimer: The information provided should be only be used as a reference and should not be considered legal advice.

About the author

Jacob Dayan, Esq. is CEO and co-founder of Chicago-based Community Tax, LLC, a U.S. provider of tax resolution, tax preparation, bookkeeping, and accounting services. He is also a managing partner of Consumer Law Group, and Illinois law firm assisting consumers with various legal needs. He began his career on Wall Street as an analyst structuring new issue mortgage and asset-backed securities. Jacob graduated Magna Cum Laude from Mitchell Hamline School of Law and holds a bachelor’s degree in Business Administration from the University of Michigan’s Ross School of Business.

Jacob Dayan, Esq. is CEO and co-founder of Chicago-based Community Tax, LLC, a U.S. provider of tax resolution, tax preparation, bookkeeping, and accounting services. He is also a managing partner of Consumer Law Group, and Illinois law firm assisting consumers with various legal needs. He began his career on Wall Street as an analyst structuring new issue mortgage and asset-backed securities. Jacob graduated Magna Cum Laude from Mitchell Hamline School of Law and holds a bachelor’s degree in Business Administration from the University of Michigan’s Ross School of Business.

Follow Lilach